Our Official Verdict

Self-Custody for Free: Spend USDC From Your Own Wallet

The Ready Lite is the most accessible self-custody card on the market. At Free, it removes the cost barrier entirely. The 1% FX fee and modest 0.5% cashback are the trade-offs for free entry, but the self-custody architecture is identical to the Metal tier. For EEA/UK users who want to test on-chain spending without commitment, this is the lowest-risk starting point.

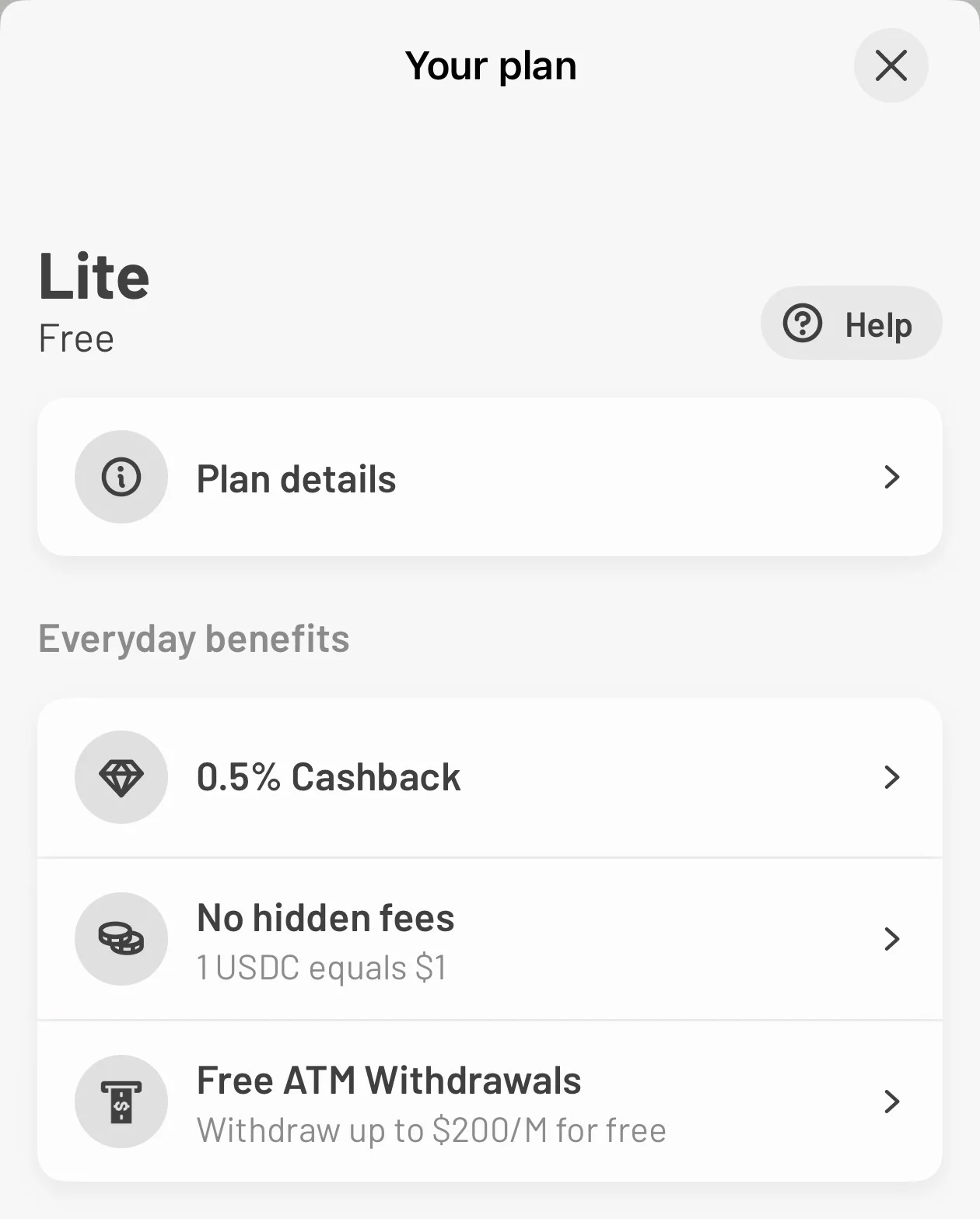

Fees & Charges

Annual Fee

Free

FX Fee

1%

ATM Fee

2%

Requirements

Supported Regions

EEA, UK

Spendable Assets

USDC

Ready Lite Card Review

The Ready Lite Card is a free self-custody Mastercard debit card on Starknet that lets users spend USDC with 0.5% cashback in STRK, 1% FX fee, and free ATM withdrawals up to $200/month.

The Free Entry Point to Self-Custody Spending

The Ready Lite Card is the most accessible self-custody card on the market. At $0 annual fee (just $6.99 shipping for the physical card), it removes the financial barrier entirely. You get the same Starknet smart contract wallet architecture as the premium Metal tier, the same spending limits, and the same Mastercard global acceptance.

Spending and Mechanics

The Lite Card operates on the Mastercard network and accepts USDC as the sole funding asset. Your USDC stays in your self-custodial Starknet wallet until you tap or swipe. The card is available as both a virtual card (instant issuance) and a physical plastic card in orange. Google Pay is supported; Apple Pay is in development.

Funding options include bank deposits (auto-converted to USDC), direct crypto purchases via Ramp or Banxa, bridging from exchanges, or transfers from other Starknet wallets for under $0.01.

ROI Analysis: What 0.5% Cashback Actually Means

At 0.5% cashback on a realistic $1,000/month spend:

- Monthly cashback: $5 in STRK

- Annual cashback: $60 in STRK

- Net after 1% FX: On a $1,000 EUR-denominated spend, the 1% FX costs $10/month. Your net position is -$5/month (FX costs exceed cashback).

This means the Lite card is not a rewards optimizer. Its value proposition is self-custody convenience, not profit. If you primarily spend in USD-denominated contexts or use it domestically in the EEA (where Mastercard's EUR rate has no FX), the 0.5% is pure profit.

Fee Analysis: The Real Cost

| Fee | Amount |

|---|---|

| Annual fee | Free |

| Shipping | $6.99 |

| FX fee | 1% |

| ATM (under $200/mo) | Free |

| ATM (over $200/mo) | 2% |

| Conversion spread | 0% (1 USDC = 1 USD) |

| Top-up fee | $0 |

| Gas fee | $0 |

The 1% FX fee applies when spending in non-USD currencies. For EEA users spending in EUR, the Mastercard exchange rate applies with a 1% markup. There are no hidden spreads on the USDC-to-fiat conversion itself.

Security and Self-Custody

The Lite tier uses the identical self-custody architecture as Metal. Your funds live in a Starknet smart contract requiring dual signatures (you + Ready co-signer). Kulipa handles card issuance and KYC but never holds your crypto. You can freeze the card instantly from the app and view your PIN securely via Face ID.

Verdict

The Ready Lite Card is the best free self-custody card available. It is not a cashback machine, it is a sovereignty tool. If you want to spend USDC from your own wallet without paying an annual fee, this is it. Upgrade to Ready Metal if you spend over $333/month and want 3% back with 0% FX.

Fees and break-even math

No annual fee means no break-even calculation needed. The only cost is the 1% FX fee on non-USD transactions. At $500/month in EUR spending, the FX cost is $5/month ($60/year) partially offset by $2.50/month in STRK cashback, netting -$30/year. For USD spending, there is no FX cost and the 0.5% cashback is pure profit.

Competitor comparison

- vs Gnosis Pay: Gnosis Pay has no published fees but also no cashback. Ready Lite offers 0.5% cashback. Both are self-custody in EEA/UK. Gnosis uses EURe; Ready uses USDC.

- vs Bleap: Bleap offers 0% FX but no cashback and no ATM. Ready Lite has 0.5% cashback and $200/month free ATM. Bleap uses account abstraction; Ready uses smart contract co-signing.

- vs KAST Standard: KAST is free with 1% cashback and no KYC, but it is custodial. Ready Lite is 0.5% cashback but self-custodial. Choose based on custody preference.

Sources

This is a debit card. Some merchants with pre-authorization holds (hotels, car rentals) may temporarily hold funds beyond the transaction amount.

You retain custody of your funds until the moment of spending. Your balance is not exposed to provider insolvency risk.

Fees shown above are the card's disclosed fees. Additional costs may apply: Visa/Mastercard network spread (typically 0.5-0.9%), crypto-to-fiat conversion spread at point of sale, and blockchain gas fees for on-chain top-ups.

Last verified: Feb 13, 2026 · Data sourced from official Ready documentation. · Methodology

★★★★☆4.5/5 App Store (2.3K ratings)