If a crypto card offers "1% Cashback" and has no monthly fee, you might wonder: How is this sustainable? The answer lies in the complex, "invisible" world of interchange fees. Every time you swipe your card at a merchant, a small percentage of that transaction is redirected from the merchant back to the card issuer. This is the "fuel" that powers the entire rewards ecosystem.

Why This Topic Matters Now

In 2026, regulators in the EU, UK, and US have capped or are attempting to cap interchange fees to "protect" merchants. For crypto card users, these caps are the primary reason why cashback rates have been dropping. Understanding the "Unit Economics" of a card swipe allows you to predict which reward programs are built to last and which are "burning cash" to acquire users.

Core Explanation (Direct Answer Format)

An interchange fee is a fee paid by the merchant's bank (the Acquirer) to the cardholder's bank (the Issuer) to cover the costs of processing, fraud risk, and system maintenance.

The Transaction "Slice"

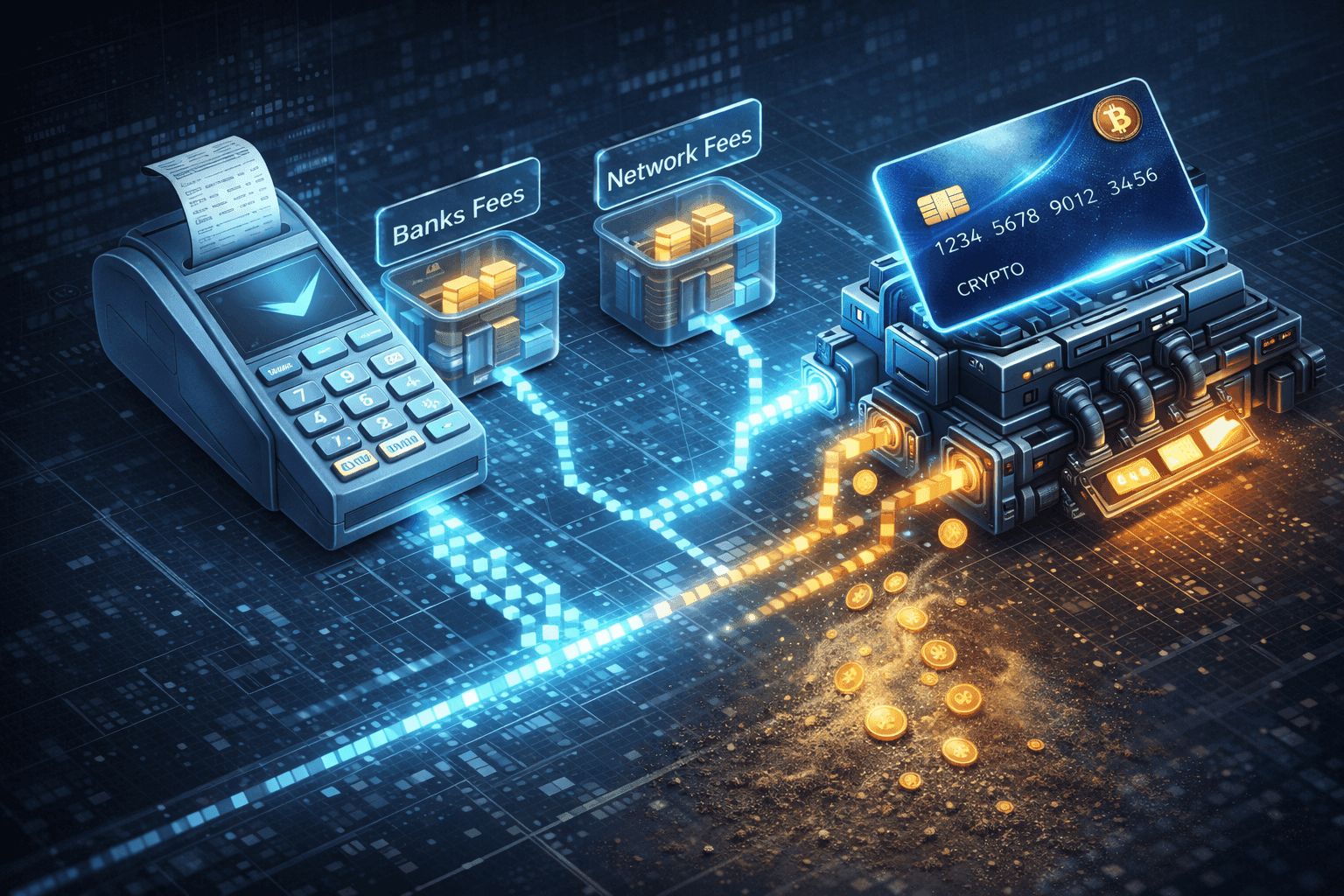

When you buy a $100 item, the merchant doesn't receive $100. They might receive $97.50. The remaining $2.50 is split between:

- The Card Scheme (Visa/Mastercard): "Scheme Fees" for the use of the network.

- The Acquirer: The bank that provides the merchant’s POS terminal.

- The Issuer (Your Card Provider): The "Interchange Fee," which is usually the largest slice.

The Regional Gap

Interchange rates vary wildly by geography. In the US, interchange on a premium credit card can be as high as 2.5% - 3%. In the EU, it is capped by law at 0.2% for debit and 0.3% for credit. This is why US crypto cards often have much higher cashback rates than their European counterparts.

Market Benchmarking & ROI Math

Is the issuer "sharing the wealth"? Let's look at the "Margin Share" on a $1,000 purchase.

| Region | Est. Interchange Revenue | Typical Cashback Paid | Issuer Net Profit/Loss |

|---|---|---|---|

| USA (Credit) | $25.00 (2.5%) | $20.00 (2.0%) | +$5.00 |

| EU (Debit) | $2.00 (0.2%) | $10.00 (1.0%) | -$8.00 |

The "Burn" Reality: In Europe, an issuer paying 1% cashback on a debit card is losing money on every swipe. They must make up this loss through other fees (conversion spreads, ATM fees, or subscriptions) or by using their native token as a "subsidy."

Real-World Implications & Regulatory Context

Under the Durbin Amendment in the US and the Interchange Fee Regulation (IFR) in the EU, the government sets the "ceiling" for these fees. For crypto card startups, this means they cannot rely on interchange alone to survive. This is why we are seeing a shift toward "Premium Tiers" and "Trading Fees" within the card apps—the interchange revenue simply isn't enough to pay for a 3% cashback program in a regulated market.

Common Mistakes or Myths

A common myth is that "The merchant pays for my cashback." While true indirectly, the merchant doesn't choose to pay you. They pay their bank, and the "rules of the network" (Visa/Mastercard) dictate how that money is shared. Another mistake is thinking that "Crypto transactions don't have interchange." If you are using a Visa or Mastercard logo, you are in the legacy system, and you are subject to the same legacy fees.

How This Relates to Crypto Cards

On SpendNode, we factor in the "Issuer's Sustainability Score." We are wary of cards that offer "High Cashback + Low Fees" in low-interchange regions (like the EU) unless they have a very clear alternative revenue stream. We believe "Transparent Fees" are better for the user than "Hidden Spreads" used to recoup interchange losses.

FAQ (Blog-Level)

Why are US crypto cards better than EU cards?

Mainly due to interchange. US issuers receive 10x more revenue per swipe than EU issuers, allowing them to offer 2-3% cashback without losing money.

Do "Free" cards make money?

Yes, but rarely from your spending. They make money from the "spread" when you convert crypto to fiat, from ATM withdrawal fees, and from selling your anonymized data to market researchers.

Can merchants refuse to pay interchange?

No, not if they want to accept Visa or Mastercard. It is a "cost of doing business." However, some merchants may offer a "Cash Discount" to avoid these fees entirely.

Overview

Interchange is the "Hidden Tax" that funds the "Free Rewards" of the modern world. For the crypto card industry, it is both a lifeline and a limitation.

As a user, understanding this model helps you spot "Predatory Spreads"—where an issuer takes your 1% interchange and charges you a 2% conversion fee—and allows you to choose the most efficient off-ramp for your digital wealth.